3D Secure

3D Secure is the protocol used to authorize online transactions with credit, debit and prepaid cards (the best known implementations are Mastercard SecureCode and Verified by VISA). Gemini Advisory experts have discovered on the dark web several discussions among cybercriminals about the techniques chosen to circumvent the protocol and make fraudulent purchases.3D Secure and security risks

The techniques are used mainly to circumvent the first version of 3D Secure which involves entering a code received via SMS to complete transactions. One of the methods involves the use of social engineering. Some of the credit cards stolen and sold on the dark web contain various user data (name, address, telephone number and others). With this information, cybercriminals contact the victim pretending to be employees of the bank to obtain the code.A similar method could also work with the second version of 3D Secure, which provides for the authorization of the transaction via smartphone app. In this case, a SIM swapping attack is exploited. Other methods involve creating a site identical to the original (the user is deceived and enters the data), using PayPal (just add the stolen credit card to the account) or installing a malware (hidden in the Android app published on the Google Play Store) on the smartphone that intercepts the code sent via SMS.

The second version of 3D Secure allows the use of biometric data (for example the fingerprint) to authorize transactions, so the risks are lower (for the moment). In Europe it is foreseen by the PSD2 directive, but in other countries the first version of the protocol is still widespread.

Source: Gemini Advisory

Hackers share methods to bypass 3D Secure for payment cards

Cybercriminals are constantly exploring and documenting new ways to go around the 3D Secure (3DS) protocol used for authorizing online card transactions.

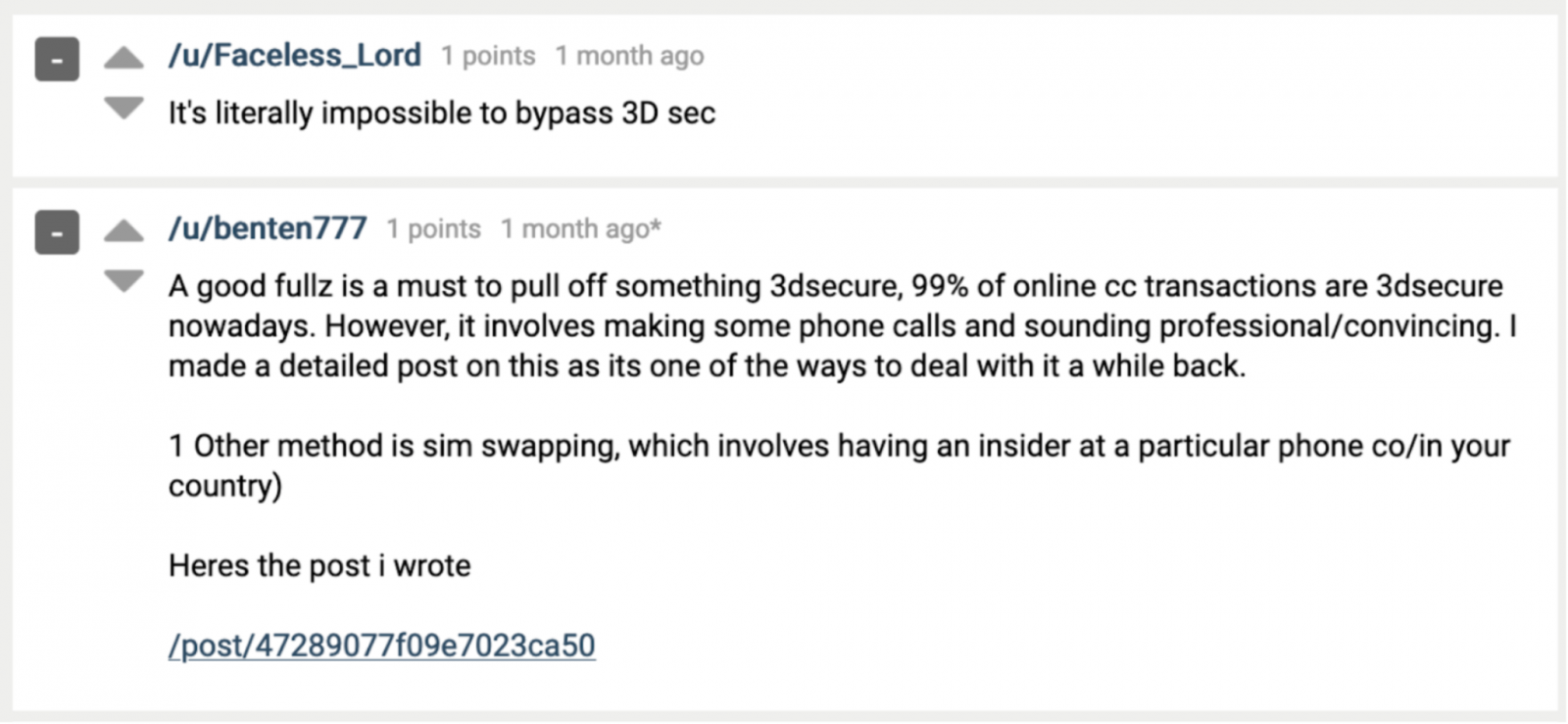

Discussions on underground forums offer advice on how to bypass the latest variant of the security feature by combining social engineering with phishing attacks.

Individuals on multiple dark-web forums are sharing their knowledge on making fraudulent purchases on shops that implemented 3DS to protect customer transactions.

3DS adds a layer of security for online purchases using credit or debit cards. It requires direct confirmation from the card owner to authorize a payment.

The feature evolved from the first version where the bank asked the user for a code or a static password to approve the transaction. In the second version (3DS 2), designed for smartphones, users can confirm their purchase by authenticating in their banking app using their biometric data (fingerprint, face recognition).

Despite the advanced security features that 3DS 2 provides, the first version is still widely deployed, giving cybercriminals a chance to use their social engineering skills and trick users into giving the code or password to approve the transaction.

Social engineering gets the 3DS codeIn a blog post today, analysts at threat intelligence company Gemini Advisory share some of the methods cybercriminals discuss on dark-web forums to make fraudulent purchases at online stores that implemented 3DS.

It all starts with full cardholder information, which includes at least the name, phone number, email address, physical address, mother's maiden name, ID number, and driver's license number.

Cybercriminals use these details to impersonate a bank employee calling the customer to confirm their identity. By offering some personally identifiable information, they gain the victim's trust and request their password or code to complete the process.

The same tactic could work on later 3DS variants and make purchases in real-time. A hacker described the method in a post on a top-tier underground forum.

Using full cardholder details, a voice changer, and a phone number spoofing app, the fraudster can initiate a purchase at a site and then call the victim to elicit the needed information.

'In the final step, the hacker advises the victim that they will receive a confirmation code for final identity verification, at which point the cybercriminal should place the order at the shop; when prompted to enter verification code that was sent to the victim’s phone, the fraudster should retrieve that code from the victim' Gemini Advisory

Getting the 3DS code is possible through other means, like phishing and injects. When the victim makes a purchase on the phishing site, the criminals pass all the details to the legitimate store to get their product.

According to Gemini Advisory's findings, some cybercriminals also add stolen credit card data to a PayPal account and use it as a payment method.

Another method is classic and involves compromising a victim's phone with malware that can intercept the security code and pass it to the fraudster.

Alternatively, many stores do not ask for the 3DS code when transactions are below a certain limit, allowing fraudsters to get away with making multiple smaller purchases.

Most of these techniques work where earlier versions of 3DS are present. With 3DS 2 still a long way from being widely adopted. Europe is leading the transition to the more secure standard (PSD2 regulation - strong customer authentication fulfilled with 3DS 2), while in the U.S. the fraud liability protection for merchants using 3DS 1 expires on October 17, 2021.

However, Gemini Advisory believes that cybercriminals will also take a stab at the more secure 3DS 2 through social engineering.